actyv introduces ActyVerse.ai

Enterprise AI platform is all set to revolutionize B2B businesses through cutting-edge AI integration.

At the core of our platform are domain-specific micro-language models. These models enable us to harness vast amounts of enterprise data, convert it into enterprise knowledge, and train the models. It also helps build solutions that leverage this intelligence, to optimize enterprise processes and drive operational efficiency.

Featured Products

Our Star

Offerings

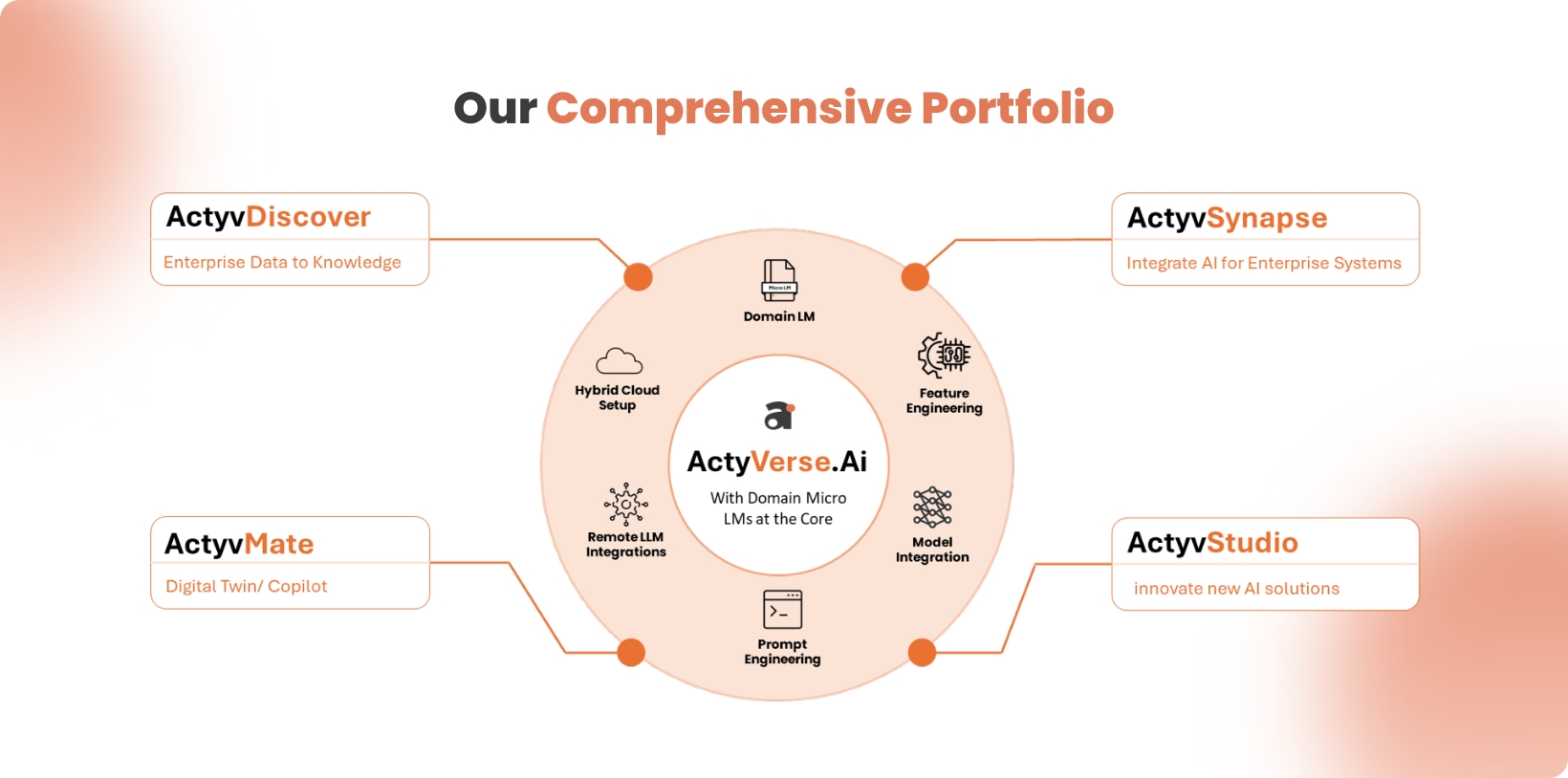

ActyvDiscover

Transforming Enterprise Data into Enterprise Knowledge

Automated discovery of task and process data, Mining and Model Training.

ActyvStudio

Innovate New Al Solutions

Collaborative workspace to accelerate new solution development, and enhancing platform functionality.

ActyvSynapse

Integrate AI For Enterprise Systems

Integrate Al with Enterprise systems to leverage inferences, exchange data, trigger actions seamlessly within the enterprise ecosystem.

ActyvMate

Digital Twin / Copilot

Digital Persona of Employees, providing insights for informed decisioning and real-time knowledge assistance.

Our Comprehensive Portfolio

Our comprehensive portfolio encompasses niche Products that are powered by a range of AI technologies, including Process Intelligence, Generative AI, and Vision AI to accelerate the adoption of AI solutions in Enterprises.

What Business Problem

Are We Solving?

Key factors contributing to the challenges to accelerate AI adoption in enterprises:

Generality Of LLM Output

Trained on infinite data of the internet, lacking domain specificity

Trained on infinite data of the internet, lacking domain specificity

Lack of precision and consistency in LLM output; critical for enterprises

Lack of precision and consistency in LLM output; critical for enterprises

Customization and fine-tuning of LLM is effort and cost-intensive

Customization and fine-tuning of LLM is effort and cost-intensive

Increase In Technical Debt

Integrating LLM with existing apps and data can be challenging

Integrating LLM with existing apps and data can be challenging

Model monitoring, maintenance, and retraining is expertise-intensive

Model monitoring, maintenance, and retraining is expertise-intensive

Optimization for speed and accuracy requires experimentation

Optimization for speed and accuracy requires experimentation

Data Security And Control

Sensitive data cannot be shared with cloud LLMs

Sensitive data cannot be shared with cloud LLMs

Compliance and regulatory objectives add complexity

Compliance and regulatory objectives add complexity

Need to manage bias, transparency, and accountability in training models

Need to manage bias, transparency, and accountability in training models

GENERATIVE AI USE CASES BY INDUSTRY

Industry Wise Use-Cases

GENERATIVE AI USE CASES BY Function

Function Wise Use-Cases

Experience The Power Of actyv.ai

Unlock the Potential of AI for Your Business with

a Personalized Demo

Follow Us On

Copyright © 2024. All rights reserved by actyv.ai