Channel Partner (Suppliers, Distributors, Dealers and Retailers) onboarding could be a challenge for enterprises. Finding the right channel partner is a boon for an enterprise in terms of compatibility and efficiency, leading to profitability. A lot of effort goes into identifying the right mix partner.

Onboarding Challenges

However, the challenges are not over once the enterprise has identified the Suppliers, Distributors and Retailers. Numerous other formalities are needed to be taken care of. There are still many hoops remaining to be jumped on both sides.

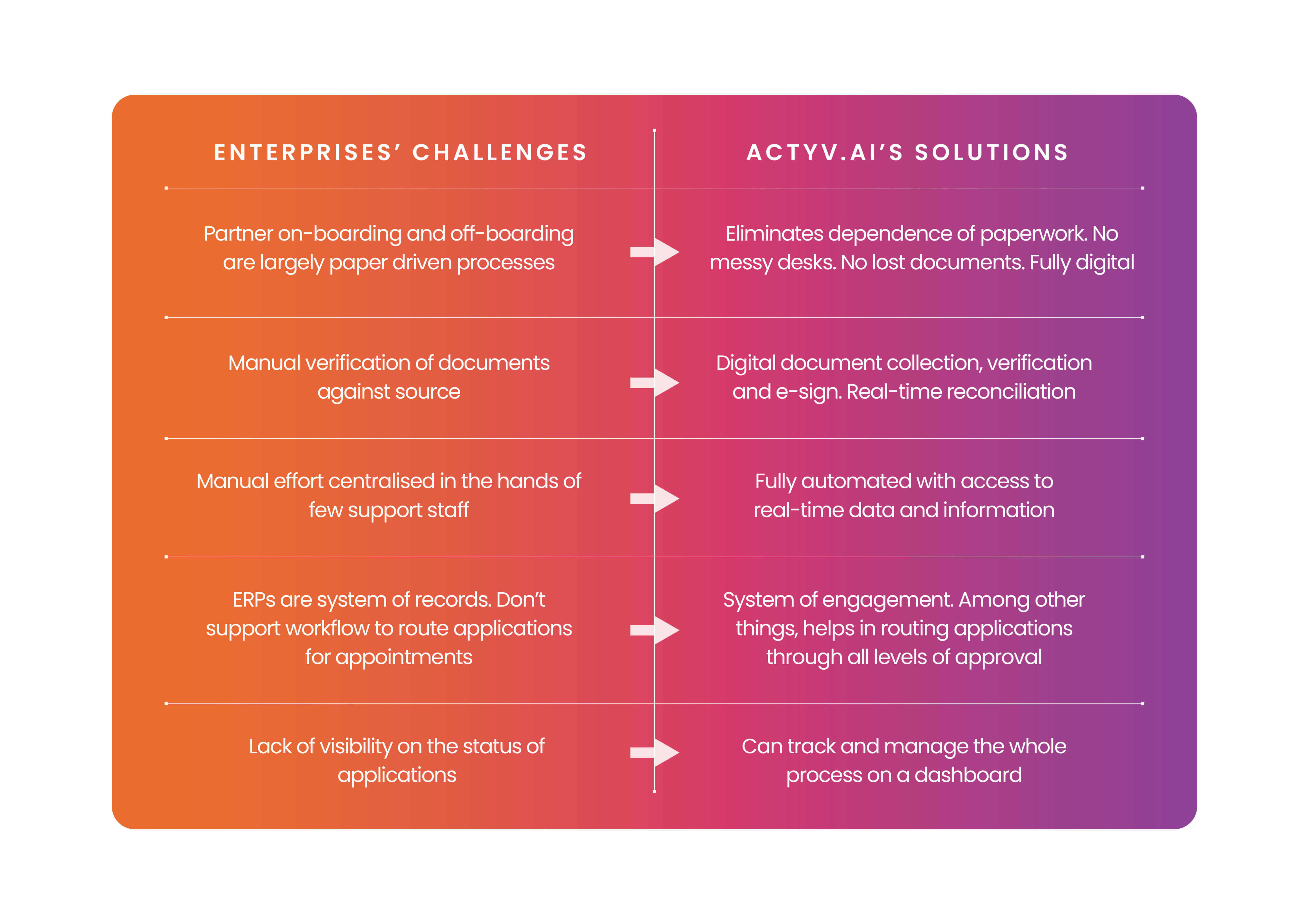

Suffice to say that channel partner onboarding is a lengthy and cumbersome process for most enterprises using the traditional Enterprise Resource Planning software (ERP) to manage the same. The ERP system, being a system of records, rely heavily on Documentation, Document submission and verification, which results in a lot of paperwork. Therefore, the onboarding challenges lie in the hassle of paperwork is time-consuming, and it generally takes between 1-9 months to the onboarding a new customer/channel partner.

The period of 1-9 months is a long waiting period for the new customer/channel partner to start a business. In addition, it results in the loss of potential business that could have been done with a willing partner during the period.

And since the system focuses on record keeping, keeping a continuous real-time check on the working of the partners and the performance of the enterprise’s product is a challenge. Not only is onboarding a challenge, but off-boarding a partner is also a lengthy process in the traditional ERP systems as real-time performance tracking is not available. Thus, it becomes a long-drawn process.

The enterprises need a hassle-free, less time-consuming system that can seamlessly onboard and off-board the Suppliers, Distributors and Retailers, thus making the business smooth.

The actyv SaaS platform for Enterprises

This is where actyv.ai comes in. It offers a SaaS-based platform that smoothens the relationship between a large enterprise and its distribution channel. It provides the company with real-time visibility on the performance of its products while allowing the channel partner the accessibility to easy credit. Furthermore, It eliminates the dependence on paperwork and reduces the time required for documentation, verification and approval.

The platform uses artificial intelligence and machine learning to solve the supply chain challenges of the enterprise and provides a Buy Now Pay Later (BNPL) facility for the distributors and the suppliers of the organization. In addition, it provides multiple services like onboarding of distributors and suppliers, inventory management, invoices, financial transactions, e.t.c.

Some highlights of our platform:

Faster onboarding of Suppliers, Distributors and Retailers

The strongest part of Aytv’s technology platform is faster distributor onboarding, which takes about three days instead of one to nine months taken by other ERP software systems. This can be attributed to the appointment of Suppliers, Distributors and Retailers with digital document collection, verification and e-sign. This reduction in time tremendously improves the profitability and efficiency of the enterprise’s supply chain. The platform also provides real-time reconciliation.

Thus, the actyv technology platform is a system of engagement that works in real-time across the supply chain providing real-time data, information and enable transactions.

Easy Availability of Credit for Distributors and Suppliers

Another great advantage of the actyv platform is the easy accessibility of credit to enterprise partners based on the actyv credit score. actyv credit score is a multidimensional credit score based on document data and transactional data.

The data used to generate the credit score include the financial and tax data of the partner, credit bureau score and transaction history to generate a report that the enterprise and the bank can use. Based on the score, banks offer unsecured loop credit to the partners in the form of Buy Now pay Later for B2B.

The BNPL application is submitted to the bank via the Acty.ai platform, and once the BNPL is active, the partner can pull payments from the credit account against invoicing. No first loan default guarantee or liability recourse is required on the part of the partner

Monitoring the financial health of the Supply Chain

The actyv platform provides the enterprise with information about the financial health of the enterprise partners and the overall financial health of the supply chain.

The actyv platform generates a financial health report. The enterprise can assess the financial health and request resubmission of documents, thus keeping a real-time check on partners’ performance and the products.

With access to this data, the enterprise can assess the requirement of new partners and the working of existing partners, and if the partnership is not found to be working, you can easily off-board a partner.

To get the actyv platform, the enterprise has to pay a one-time licensing fee once the SaaS platform is deployed. Payments need to be made by the enterprise every time a distributor is onboarded to the platform of the enterprise.

So, if you are running an enterprise and are looking to improve the efficiency of your supply chain, please reach out to us (link) and request a demo.