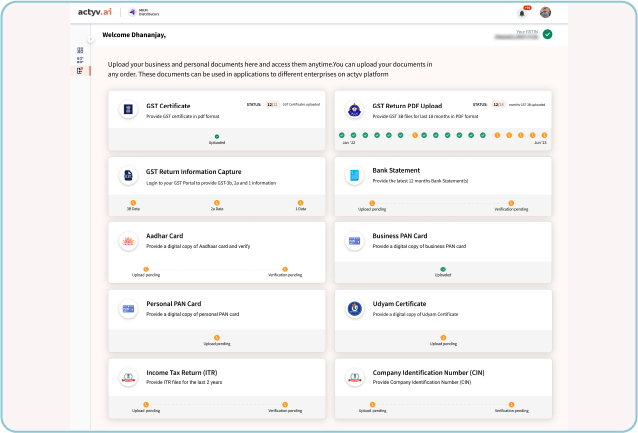

Embedded finance offerings for the B2B ecosystem orchestrated on a single platform enabling enterprises, distributors and retailers, and financial institutions to rapidly grow their business.

actyv.ai brings together cutting-edge technology and embedded financial offerings, catering to each of the B2B supply chain ecosystem stakeholders. Onboard business partners rapidly in a completely digitized process using actyv Go. Ensure data-backed decision-making and remove subjectivity while onboarding business partners leveraging actyv Score. Get access to embedded buy-now-pay-later payment options for your working capital needs through actyv PayLater and secure your BNPL credit through bite-sized actyv Insure.

|

|

|

|

|||||

|---|---|---|---|---|---|---|---|---|

| Enterprises |

actyv Go |

Reduced onboarding time Rule-based onboarding Better compliance |

actyv Score |

Pick right distributors Reduced distributor churn Proactive distributor monitoring Reduced bad debt |

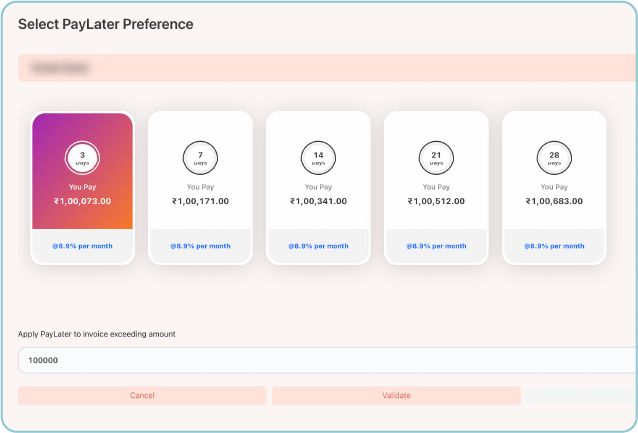

actyv PayLater |

On-time payments Business growth |

actyv Insure |

Non-discretionary elimination of business continuity risk |

| Distributors, retailers & suppliers |

actyv Go |

Reduced manual effort Faster business offtake Impartial evaluation |

actyv Score |

Improve financial efficacy |

actyv PayLater |

Faster access to affordable working capital Reduction in cost of capital |

actyv Insure |

Protection against business & personal loss |

| Financial institutions |

actyv Score |

Credit risk evaluated customers |

actyv PayLater |

Sticky customer base Low acquisition cost Purpose-driven credit |

actyv Insure |

Protection on credit transaction |

||

| Insurers |

actyv Score |

Risk evaluated customers |

actyv PayLater |

Low acquisition cost |

actyv Insure |

Sticky customer base |

||

A seamless onboarding and scoring experience with access to embedded finance offerings on a single platform

actyv.ai is a cloud-native platform which can be configured to specific enterprise / geographic requirements