Supply-chain is a complicated ecosystem which requires the collaboration of various partners. The intrinsic connections between manufacturers and their distribution channels are complex. Many organisations suffer due to the lack of effective communication and collaboration platforms.

The supply-chain challenges are immense for enterprises. Scouting for new distributors and other channel partners together with keeping the existing setup functional without affecting the growth becomes a daunting task for many Enterprises worldwide. SMEs, who are part of the enterprises’ supply chain also have difficulties acquiring credit from banks, which further restricts their growth. At actyv.ai, we understand the challenges and troubles of organisations in communication and execution with supply chains and channel partners. We realise the pain of being unable to get your business growing in the absence of capital and accessible credit facilities.

The lack of comprehensive credit scores for SMEs was a major challenge, leading us to experiment and brainstorm. Our team innovated an automated multidimensional credit limit and score calculator based on real-time data including financial and non-financial transactions. Large corporations benefit from actyv.ai to transform their supply chains and promote their partners.

Before diving deeper, let's first understand how our scoring system works.

actyv Score: Our AI-driven credit score solution

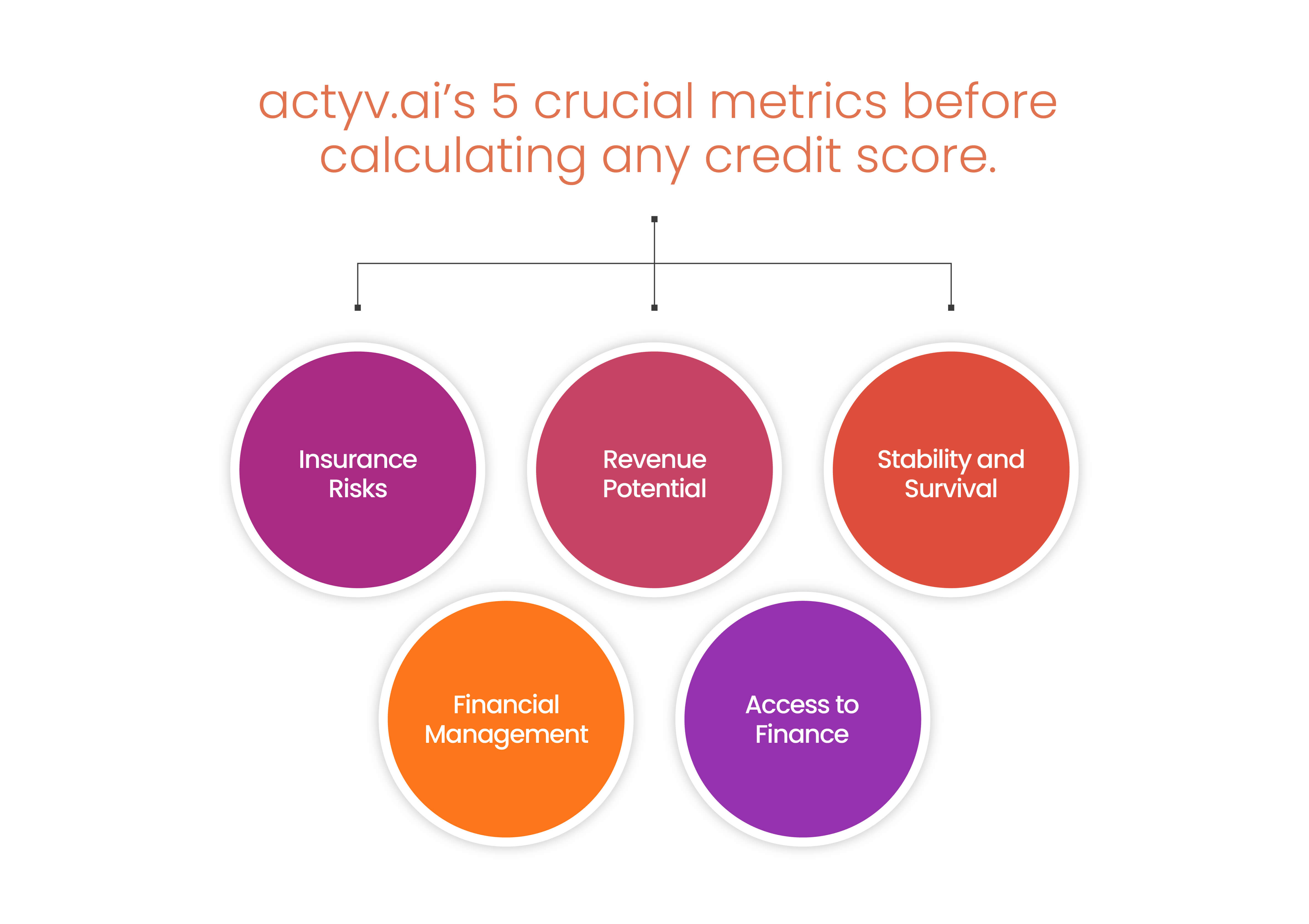

actyv.ai calculates dynamic and modern credit scores driven through multiple touchpoints, a score which accurately and fairly reflects any SMEs existing conditions. actyv.ai considers 6 crucial metrics before calculating any credit score. These include Insurance risks, revenue potential, stability and survival, financial management and access to finance. The score enables enterprises to track each of their distributors on each of these 6 constituent parameters, set benchmarks, measure performances and support growth. The scores are derived in real-time through transaction history, including financial and non-financial data.

The metrics we mentioned above are calculated through different input functions. actyv.ai digitally reads and analyses the bank statements, where even check bounces are considered. GST and IT return data are checked along with fraud checks to ensure the validity of furnished data. Credit scores of the SMEs and promoters are retrieved from multiple credit bureaus.

After analysing the above metrics, actyv.ai generates an automated, dynamic credit score and a detailed report on the SME's financial health, which, for a business is akin to the pulse check in a human. actyv Score can be regenerated on-demand or according to a schedule. The system finally generates a credit limit for the enterprise and banks to use as is.

Tech-enabled approach

We always believe in leveraging technology to solve problems. The complexities of the supply chain and the co-dependence of multiple functions like the supply of goods, maintenance of records, financial transactions, and product performance need to be smooth and functional for the growth of any organisation. Companies are often dependent on multiple software solutions for these functions.

actyv.ai is committed to eliminating significant supply chain challenges by offering a single platform to effectively communicate with channel partners and distributors and analyse the performance in real-time. This enables quick actions and responses when things go south. It also helps in efficient tracking of the functions affecting growth.

With actyv.ai, you can onboard partners faster, get payments instantly and improve the financial health of your supply chain. We are determined to bring access to financial credit to SMEs distributors and suppliers. Thanks to our fool-proof scoring model driven by machine learning and AI, banks recognise our scoring system to underwrite their loans without any collateral.

Practical and effective

actyv.ai is constantly innovating for Enterprises and SMEs to have a healthy supply chain and access to financial credit. We combine the powers of data and AI to continually track the financial health of your partners and the financial health of your overall supply chain on a single dashboard.

We make collaboration among teams in your supply chain seamless, practical and effective. With actyv.ai, you can not only generate financial health reports but also request resubmissions of documents like GST returns and keep your health report updated. Access to rich data through the platforms helps you make informed decisions. You can review your existing partners while locating the new ones to grow and expand. The offboarding and onboarding process is easy, and terminations can be done seamlessly if a partnership isn't working well. The organisation is always in complete control of the total and current limits. actyv.ai can also run your campaigns internally to drive sales and reward the best performers.

actyv.ai gives you the chance to bring all your teams together and collaborate efficiently towards a common goal. Get your teams working through a single source of truth and bring the power of data and technology to your organisation today. Connect with one of our experts (link) or schedule a demo today.